Making a living doing your thing on the internet is the dream for a lot of people. However, few consider all of the logistical issues that come with that dream. Working for yourself means having to take care of everything on your own. You need financial tools, but those are more than just apps.

Financial tools can also mean learning how to be an expert planner. Financial planning means thinking about budgeting, retirement planning, and debt management. That can be a little overwhelming. So here’s a guide to some of the most useful financial planning tools for content creators.

Financial Tools To Help You Not Go Broke Making Stuff

You Need a Budget

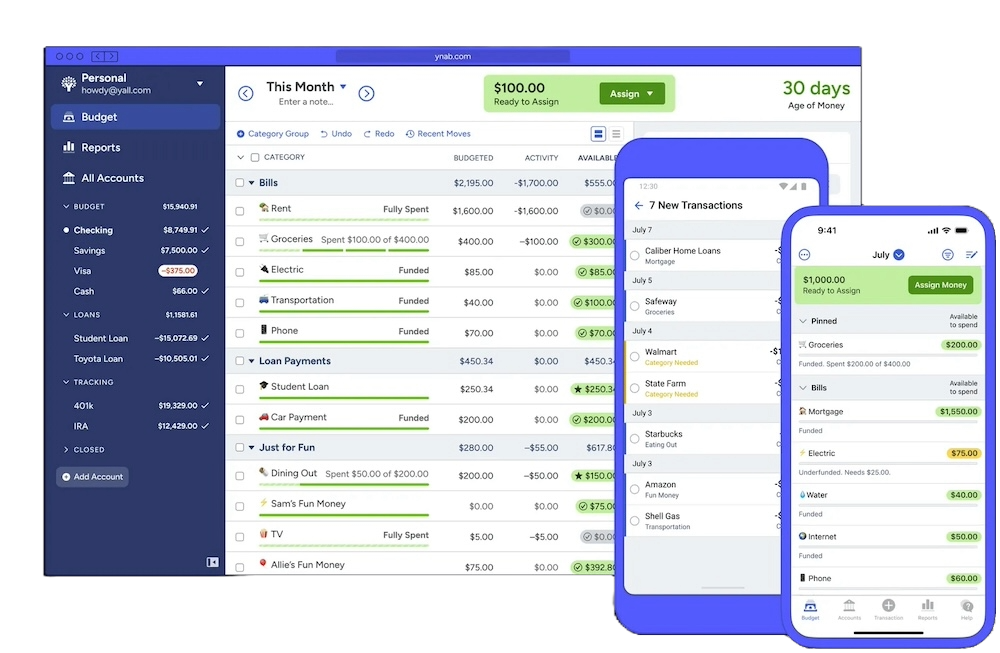

Budgeting sounds boring and onerous, but it’s one of the best things you can do for your finances. And once you get into it, you might even find you enjoy it. My favorite budgeting tool is You Need a Budget (YNAB), which has a web app and mobile apps.

The tool is built on what’s called the envelope budget system. The idea is that whenever you receive money, you assign it to different things you might want or need to spend it on. Historically, people have done this literally using cash and paper envelopes. But YNAB lets you do this digitally. You can access and update your budget on your computer or on your mobile device.

The idea is to build out a full picture of your expenses like rent, utilities, internet, and so on. Then, whenever you get paid, you put money in each of these buckets so that when the bills come due, you’re ready to pay them.

How to Use YNAB

Once you sign up for a YNAB account, you can create your first budget. Here’s how to do it.

Step 1) Create categories for all of your expenses. It’s easier to do this if you break them down into groups. YNAB suggests some by default, like a “Regular Obligations” group that includes things like utilities and rent. Don’t worry if you miss something. You can always add more categories later.

Step 2) Add your bank accounts. You can either sync your accounts automatically or manually update them.

Step 3) Assign all of your money to different categories. Whenever you get paid, assign that money too. The goal is to give each dollar a job, whether that’s paying this month’s rent or getting coffee.

Step 4) Set targets for each category. This helps you know whether you’re on track to meet all of your expenses.

Step 5) Move money around as necessary. Budgeting shouldn’t feel restrictive. Sometimes, you find you need more money in a category than you thought. YNAB lets you fund one category of expenses with money in another to keep things flexible.

This system takes some work to set up, but once it’s in place it grants you a lot of freedom. It’s hard to budget if you’re trying to keep track of all of your expenses in your head. And YNAB also lets you plan for longer-term purchases too. Say you want to save up for a new camera or PC. In YNAB, you can create a category and set a target to save a certain amount of money each month.

I started using YNAB in 2018. Since then, I’ve paid off all of my credit card debt and built up some emergency cash savings. More generally, having a real picture of my expenses has changed my relationship to money. I used to feel anxious and stressed about it, but now I’m able to plan for recurring bills, big purchases, and unexpected expenses.

YNAB offers a 34 day free trial that you can use to get a feel for the tool. Once the trial ends, it’s currently $109 for a year of the service. That might seem like a lot, but in my experience it pays for itself. I don’t love that it’s a subscription-based service rather than a one-off license. However, that’s the case for most similar products these days.

There used to be more software alternatives to YNAB, but unfortunately, some have shut down. You might want to check out Quicken Simplifi if you don’t like YNAB. Alternatively, you could make your own budget spreadsheet. But unless you’re an Excel whiz, that might be more trouble than it’s worth.

Plan Long-Term

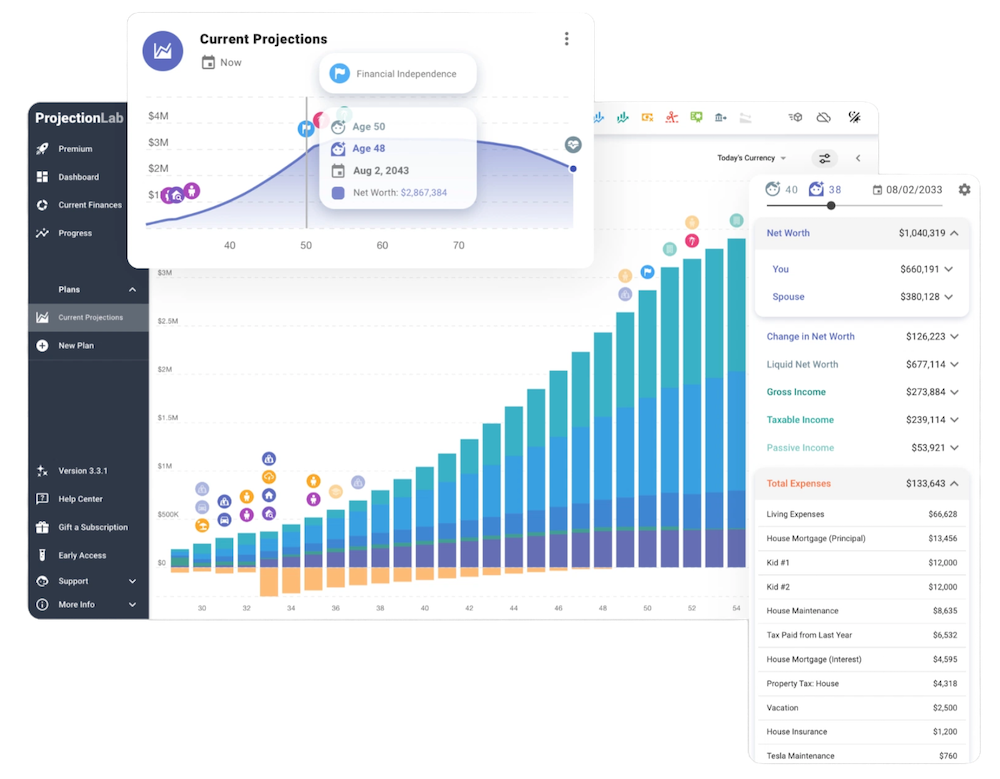

A budget is the ultimate financial tool. Budgeting is the first step towards good financial planning. But it isn’t the whole picture. If you’re trying to pay off debt or plan for retirement, you need tools to project into the future. A service like ProjectionLab provides a detailed analysis of your finances and allows for future planning.

ProjectionLab is capable of some pretty complex projections. You might not need to use all of its features, especially if you’re just getting started thinking about your finances. If you just want to do some simple calculations, there are some very useful calculators out there that can be helpful. For instance, Investor.gov offers a savings calculator that can help you estimate your ability to save long-term.

Investor.gov offers some other useful tools, as well. They have a “retirement ballpark calculator” which gives a broad estimate of what you might need to save for retirement. Another helps you calculate compound interest. These tools are all free, so it’s worth checking them out and playing around with.

By the way — if you’re trying to save money, a good rule of thumb is to try and live off of 90% of your income. This isn’t possible for everybody, but putting aside even 10% of what you make can have a big impact.

YNAB refers to this kind of thing as “aging your money.” The idea is to put as much time as possible between getting money and spending it so that you have more financial freedom and less stress.

Another Thing: Start a Separate Business Account

Even if you don’t actually start a legal business for yourself, it’s worth considering having a separate business bank account with its own debit and/or credit card.

One major advantage of doing this is that it simplifies tax season. Look for a fee-free checking account at places like Bluevine, U.S. Bank, and Grasshopper.

If you don’t want to start a separate business account just yet, be sure to keep track of business versus personal expenses. When it comes time to pay taxes, you may be able to claim certain expenses related to your business.

Get Advice from a Qualified Expert

Getting a budget, separating out your business finances, and planning for the future are all important. And using tools like YNAB and savings calculators is immensely helpful. But, of course, I have to say that I have no real expertise in financial issues.

If you’re serious about financial planning as a content creator, you should get in touch with a qualified financial advisor. If possible, look for one who specializes in freelance and self-employment situations.

A financial advisor can also assist you if you’re thinking about investing in stocks or something like an individual retirement arrangement (IRA).

You might also want to look into robo-advisors. These are automated digital platforms at places like Betterment and Wealthfront that can provide algorithmically-driven financial planning services.

The advantage of robo-advisors is that they’re often much less expensive than seeking the services of a human advisor. The main disadvantage, of course, is that you aren’t dealing with a human being.