The least exciting part of venturing out life as a self-employed creator is figuring out your taxes. What you may not know is that many self-employed individuals don’t pay taxes once a year. They cut them up into quarterly payments and pay four times a year. Fortunately, as daunting as quarterly tax payments may sound, they don’t have to be.

What Are Quarterly Tax Payments and Who Has to Make Them?

Quarterly tax payments are an estimated portion of your annual tax liability paid in installments to the IRS each year.

Think of it like this: with a W-2 job, part or full-time, your taxes are withheld from each paycheck. The IRS expects everyone to similarly pay taxes (or, at least, estimated taxes) on their income as they receive it. People who don’t have taxes withheld automatically by an employer generally still owe that money to the IRS.

So who has to make these estimated payments? If you’re self-employed, this very well may apply to you. If you’re a W-2 employee or if you have mixed 1099 and W-2 income, you may be affected as well.

However, as an individual, you’re likely exempt from having to pay estimated quarterly taxes if at least one of the following applies:

- You’ll owe less than $1,000 in taxes at the end of the year after withholding and credits.

- The amount withheld from your paychecks, plus refundable tax credits, covers 90% or more of your tax liability for the current tax year.

- The amount withheld from your paychecks, plus refundable tax credits, covers 100% or more of your tax liability from the previous tax year (110% if your income was above $150,000).

- You had no tax liability the previous year.

When Are Quarterly Tax Payments Due?

The exact dates quarterly tax payments are due can vary slightly year-to-year. However, they generally fall around the following dates:

- April 15 (for earnings made between January 1 and March 31)

- June 15 (for earnings made between April 1 and May 31)

- September 15 (for earnings made between June 1 and August 31)

- January 15 (for earnings made between September 1 and December 31 of the prior year)

There are a couple things to pay special attention to here:

1. Due dates span two calendar years.

As you may have noticed, the final due date is actually in January of the year following the pay period in question. The cycle then restarts, with your first quarterly payment of the next tax year due in mid-April. This usually means you’re filing taxes for the prior year and making your first estimated quarterly payment for the next year at roughly the same time (mid-April).

2. The year is not divided equally.

Rather than having payments due every three months, earning periods are divided into three months, two months, two months, and four months. The IRS still recommends making equal payments, but if your income is uneven throughout the year, there’s another way to handle these payments (which we’ll get to shortly).

3. These dates sometimes fall on weekends or holidays.

When one of the standard deadlines falls on a weekend or holiday, the date is pushed to the following business day. For example, in 2024, June 15 was a Saturday, so the deadline for that quarter was actually June 17, a Monday.

How to Estimate Quarterly Tax Payments

In order to estimate your quarterly tax payments, you have to make a guess as to how much money you’ll make over the course of the year. You can do this using the IRS Form 1040-ES worksheet for the corresponding year, which will walk you through all the information you need.

If you have a relatively steady income, this is simple. Once you’ve calculated your projected tax liability for the year, you divide that by four, and pay that amount each quarter.

If your income varies more drastically throughout the year, things might be more complicated. You may not be able to accurately project your annual income, or you may not have access to the necessary funds to pay equal amounts each quarter.

In that scenario, you may want to use the Annual Income Installment Method. This allows you to pay taxes each quarter on the amount you actually made during that period. If you choose to do this, you’ll need to file a Form 2210 alongside your annual taxes.

How to Make Quarterly Tax Payments

After you’ve estimated how much you owe, there are several ways you can make your quarterly tax payment.

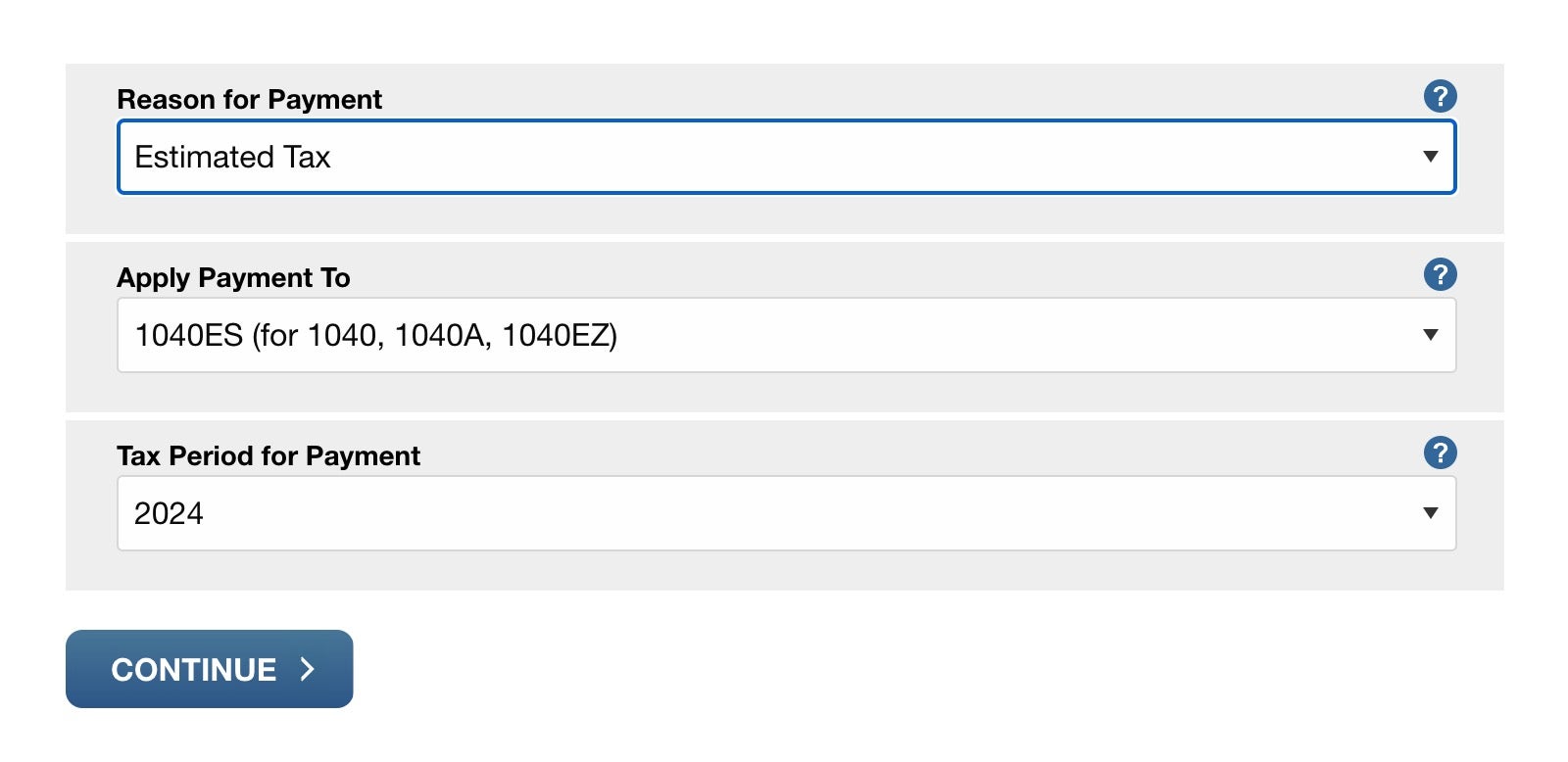

Pay online

To pay online via your bank account, you can go directly to the IRS website and follow the instructions laid out for you. You’ll have to provide your basic information (eg. name, social security number, address).

Alternately, you can pay using a debit or credit card. To do this, you’ll have to go through a third party listed on the IRS website, and will incur an additional fee (the amount varies).

There’s also the option to pay via the Electronic Federal Tax Payment System (EFTPS), which requires enrollment, but offers added conveniences such as scheduling payments and viewing your payment history.

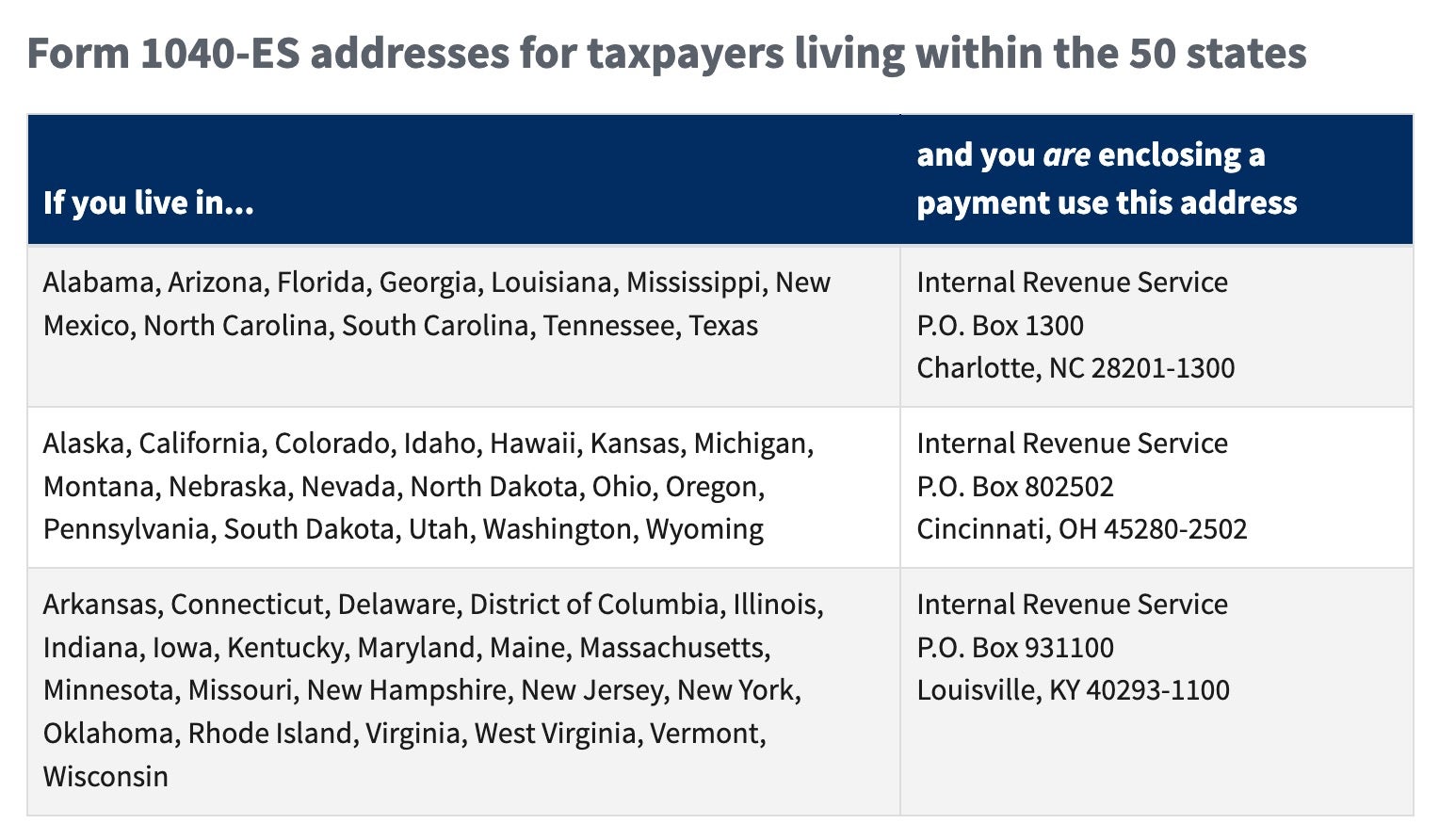

Pay by mail

If you prefer to pay by mail, you’ll need to fill out a Form 1040-ES and submit a check, money order, or cashier’s check to the address that corresponds with your state of residence.

Pay by mobile app

The IRS also offers a mobile app through which you can pay directly: IRS2Go.

What Happens If You Miss a Quarterly Estimated Tax Payment?

If you miss a quarterly estimated tax payment, you may ultimately incur a penalty for late payment once your yearly taxes are filed. This can also happen if you underpay your estimated taxes.

If this applies to you, you’ll receive a letter from the IRS telling you how much you owe. This amount will be up to 0.5% per month on the amount you owe, up to a 25% total increase. You may also be charged interest on the penalty fees, depending on when you ultimately pay.

However, there may be exceptions. You can request a waiver “due to a casualty, disaster, or other unusual circumstance and it would be inequitable to impose the penalty.”

You also may be in the clear based on the IRS’s “safe harbor” rule. This means you won’t incur a penalty for underpayment or missed quarterly payments as long as you meet one of three requirements:

- Your final tax liability for the year after withholdings and credits is less than $1000.

- You paid at least 90% of your final tax liability in quarterly payments.

- You paid at least 100% of the previous year’s tax liability in quarterly payments (110% if your income was $150,000 or more).

So, for example, if your tax liability at the end of the year turned out to be $10,000, and you paid $3,000 for three quarters, then missed the fourth quarter, you wouldn’t face any penalties, as you had covered 90% of your final tax liability for the year.

Can I Choose Not to Pay Quarterly Tax Payments?

Technically, yes, you can choose not to pay one or more quarterly tax payments. But if it turns out you fall under the umbrella of people who should have done so, you’ll have to pay a penalty.

Some people opt to go this route, particularly independent contractors with income that is uneven or unpredictable throughout the year. It’s up to you to decide whether it makes more sense to have cash on hand during the year and pay extra at the yearly tax due date, or pay less upfront.

Do I Have to Pay Estimated Taxes at a State Level?

Most states require estimated tax payments as well, but the conditions surrounding who is required to pay them varies. Check with a tax professional in your area or find your state tax website for more information.

As daunting as taxes can be, it’s always better to do what you can to be informed and prepared early, rather than waiting until the last minute. For more tips, check out our list of things most content creators miss on their taxes.