CREATOR ECONOMY NEWSLETTER

Issue #104 | Jan. 31, 2023

Did you know tax season kicked off this month? As the Apr. 18 deadline for filing your taxes approaches this year, it’s good to get your documents prepared. For creators who monetize their content online, having additional income also comes with the responsibility of a different kind of tax reporting.

As Passionfruit contributor Rachel Kiley explains this week, creator income is often classified as self-employment income—which veers into different paperwork, additional taxes, and a new line of available deductions.

Read more below to find out if you qualify as self-employed, what information you need to file taxes as a creator, and more.

– Grace Stanley, Newsletter Editor

TOOLS REVIEW

How to file taxes as a content creator

Here’s how to get started with taxes as a creator.

By Rachel Kiley, Passionfruit Contributor

SPONSORED

Light up your new year with new gear

Make your content shine with the Lume Cube Mobile Creator Lighting & Audio Kit. The essential 3-in-1 setup gives you everything you need to create the next viral TikTok.

ONE GREAT TIP

“You don’t want to be in a situation where a company approaches you, and you give them something that’s way below what they were expecting. Try to get them to offer first.”

—YouTuber SungWon Cho on negotiating brand deals. Read more in our January 2023 interview.

FROM THE INSIDE

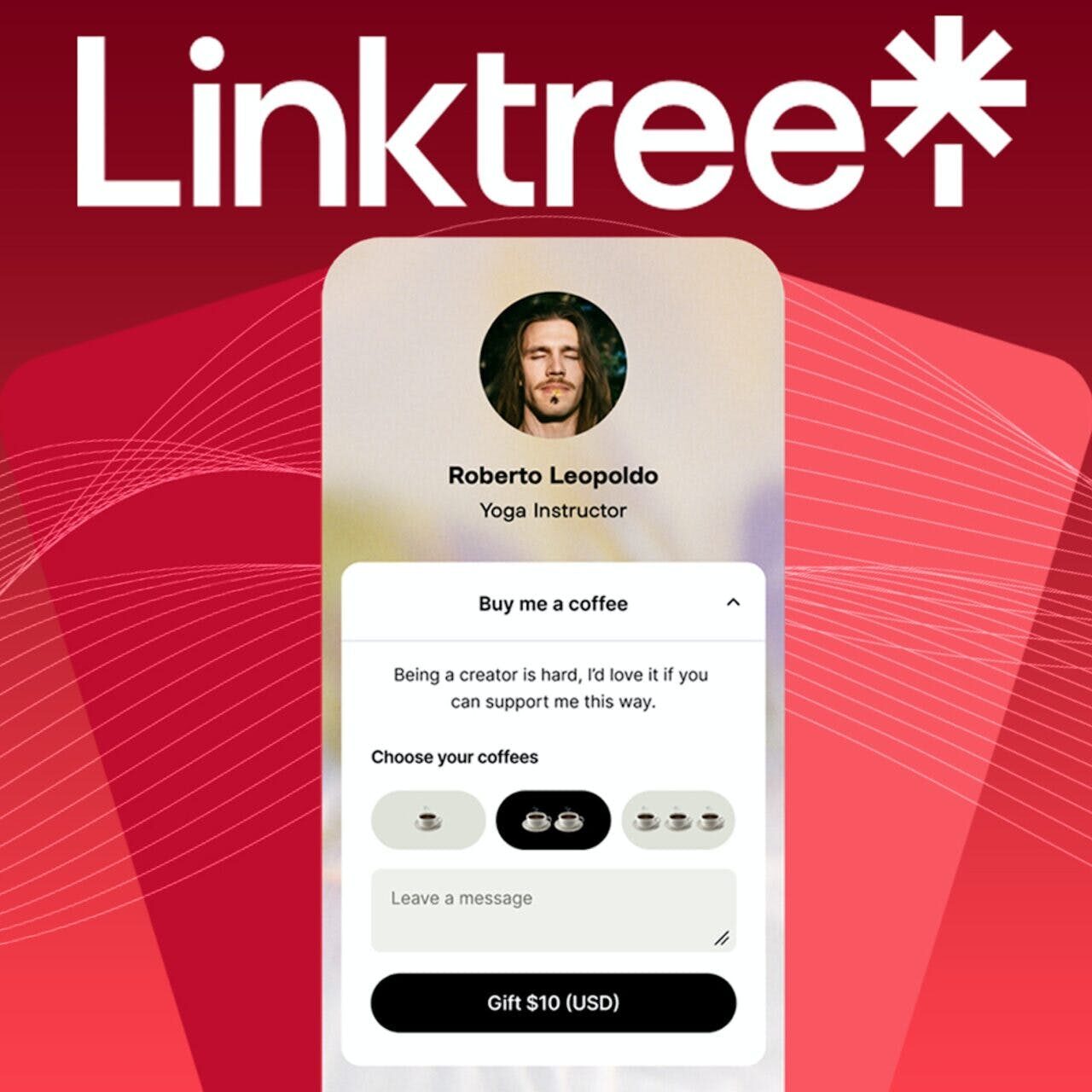

Linktree unveils 3 new monetization features, including a Buy Me a Coffee lookalike tool

One of these new features looks a little familiar.

By Charlotte Colombo, Passionfruit Contributor

TIPS AND TRICKS

Swell Entertainment’s Amanda Golka describes her candid approach to YouTube

‘I don’t have a script 90% of the time’

By Paige Lyman, Passionfruit Contributor

IN THE BIZ

- Twitter announced creators and brands can now target users for advertising based on keyword searches.

- LinkedIn announced new platform updates, including the ability to schedule newsletters through its platform.

- MrBeast is catching viral attention and controversy for a video where he paid for the surgeries of over 1,000 people with Blindness.

- Julia Fox sparked debate after misinterpreting a “mascara” related trend on TikTok. (via Buzzfeed)

- Meta is cutting back on creator payments for Facebook Gaming, its Twitch competitor. (via the Information)

- Stripper Web, a popular forum for adult entertainers, shuttered after 20 years. (via the Daily Dot)

- Substack introduced private newsletters that readers can request to subscribe to. (via TechCrunch)

- Gaming organization FaZe Clan announced its latest collaboration with Disney.

TIKTOK MADE ME DO IT

This trending Doctor Who audio caught our attention this week.