Content creators of any stripe, whether they’re writers or OnlyFans creators, are small business owners. With this ownership comes income (we hope) and, eventually, the requirement to pay taxes. Since you’re self-employed, taking out taxes and filing the appropriate forms is solely your responsibility.

If this is all new to you, it can seem daunting. However, don’t fret; we’re here to help you get started figuring out OnlyFans taxes. Note: We are not legal or tax professionals. If you have questions, you should consult with one of those.

OnlyFans Taxes and You: The Basics You Need to Know

OnlyFans is particular about tax compliance and requires that all creators fill out tax forms before engaging on the platform. They also require that you remain in compliance with all tax laws.

Keeping the company informed of all notifications from the IRS is vital. Keeping good records regarding your OnlyFans taxes is a great place to start. That way if you’re ever questioned about any deductions or income, you’ll have all of your ducks in a row.

Is OnlyFans Taxable?

Yes, any income you earn from OnlyFans is taxable. This includes subscription fees, tips, pay-per-view (PPV) income, and donations. Your OnlyFans income is subject to tax just like your earnings from a regular job.

The difference is that you’re responsible for paying it directly to the IRS. You’ll need to keep track of your earnings throughout the year and determine how much self-employment tax to pay quarterly.

What Is Self Employment Tax?

As a content creator on OnlyFans, you’re considered self-employed, an independent contractor, so you’re not an employee of the platform. Therefore, Fenix International, the company that owns OnlyFans, will not take out taxes from your earnings.

This can be confusing when you start using OnlyFans since the company takes 20 percent of your earnings.

That 20 percent is their fee for hosting your content on their platform and has nothing to do with taxes. Self-employment tax equals 15.3 percent. This consists of Medicare tax (2.9 percent) and Social Security tax (12.4 percent). The same is true of FICA tax deducted from salaried employees’ paychecks.

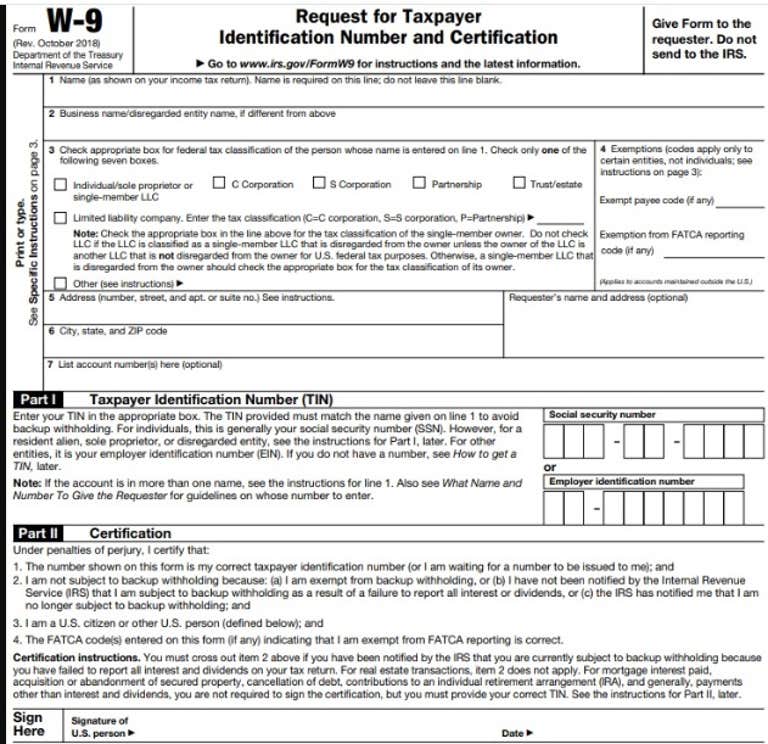

How To Fill Out W9 For OnlyFans Taxes (Step-by-Step)

If you’ve never filled out a W-9, it can look intimidating, but don’t worry, it’s fairly self-explanatory.

Here are step-by-step instructions to help you out:

- Line 1: Your full legal name as shown on your ID.

- Line 2: Leave this box empty unless you have a “doing business as” (DBA) name or a legal liability company (LLC)

- Line 3: Check whichever box applies to your situation; most likely it will be the first box, “Individual/sole proprietor, single entity LLC.”

- Line 4: Leave blank unless it applies

- Line 5: Street address (Yes, a PO Box is okay)

- Line 6: City, State, and Zip Code

- Line 7: Leave blank

Requester’s Name and Address: Leave Blank

Part I Tax Payer Identification Number (TIN): Enter your Social Security Number in the first box, or Employer ID Number (EIN) in the second box if you have one.

Part II Certification: Add your signature and date the form.

Once you complete this form and upload it to OnlyFans, you can withdraw funds you’ve earned from the platform.

The OnlyFans 1099: When and Why Do You Get It

Once you’ve earned $600 in a calendar year from OnlyFans, they’re required by law to send you a 1099-NEC form. NEC stands for Non-employee Compensation. This form lets you know how much money you’ve earned from the platform over the course of the year, over $600, which is your gross income.

However, it’s important to note you still have to report whatever amount you made to the IRS on your annual income tax return. This is why it’s vital to keep track of your earnings and not rely on the platform to disclose them to you. By law, they must send the 1099-NEC to you by January 31st for the previous year.

1040 Schedule C, Schedule SE, and You

You’ve got your 1099 and you know you’re a small business, so now it’s time to file those taxes! You’ll file a standard 1040 form, but in addition to this, you’ll also need to file a Schedule C (Profit or Loss From a Business).

It’s on this form where you’ll note the gross income listed on the 1099-NEC you received from OnlyFans. It’s also where you’ll be able to disclose any business expenses you’ve incurred. Any remaining amount is your net income, which is what you’ll have to pay taxes on.

Once you’ve completed Schedule C you can move on to Schedule SE, which is the Self Employment tax form. This is where you’ll figure out how much self-employment tax you owe based on your net income after deducting all your business expenses.

What Are Business Expenses Relating to OnlyFans?

When you’re running your own business like OnlyFans and having to pay taxes out of your pocket, it’s imperative to keep track of any expenses you incur. The more you can subtract from your income, the less tax you have to pay, which is a good thing.

You just want to be sure what you’re writing off is an actual business expense. IRS will fine you for claiming something as an expense that doesn’t count.

For the purposes of OnlyFans taxes and your business, these items would be considered appropriate business expenses:

- Equipment you purchased or rented for content creation, such as computers, cell phones, video cameras, cameras, sound equipment, or props.

- Wifi and/or data usage. As your business is entirely online, you can write off your internet plan based on use. For example, if you spend 25 percent of your monthly data usage on OnlyFans, then you can claim 25 percent of what you spend on it as a business expense.

- Travel expenses to locations for shooting content.

- OnlyFans platform and transaction fees.

- Clothing used exclusively for this business. Any easy way to decide if clothing counts is, would you wear it on the street? Then it probably doesn’t count.

- Promotional and marketing expenses. If you pay someone to help you answer messages, pay for social media promotion, etc.

- Rental fees, if you rent space for shooting content, you may be able to deduct this expense.

- Makeup and other beauty supplies, if they’re used exclusively for content creation. So keep these separate from your normal items.

- Commissions paid to professionals, such as video and audio editors to make your content better.

A Note About Expenses

If the expense promotes and makes your business better and is considered normal in the commission of your business, then it can likely be considered a deduction. It’s always a good idea to have records of any expenses you incur to back up what you’re claiming in case you’re ever audited.

It can also be helpful to have a separate bank account for this business, to have your income deposited into and also have deductions come out of, to make life easier. If you don’t use this account for anything else, it should always represent your profit and loss.

When Are OnlyFans Taxes Due?

Technically, taxes are due April 15th each year, but when you’re self-employed and you know you’ll owe more than $1000 in a year, you are supposed to pay quarterly. Quarterly taxes are due April 15th, June 15th, September 15th, and January 15th (next year).

If you decide to wait and only pay once a year, you could owe penalties and interest. While paying four times a year may seem bothersome, it can also be helpful to split up what you think you’ll owe over four payments rather than coming up with a larger lump sum at once.

You’ll estimate your payments since you don’t have to fill out a 1040 form yet, so the IRS allows a 10 percent margin of error. Filing the 1040, Schedule C, and Schedule SE forms happens in April like usual–you’ll use form 1040 ES with each estimated tax payment until then.

When You Should Involve a Tax Professional With OnlyFans Taxes

Filing taxes can be daunting, and deciding whether to be a sole proprietor or start an LLC can be scary. If you are unsure how to get started with any of this, consulting a tax attorney or a licensed, certified public accountant (CPA) might be a good place to start.

They’re trained professionals who can give sound advice on getting started on the legal side of things and help you make good choices. Also, if you’ve filed your taxes and you’re ever audited or contacted by the IRS about your taxes, that’s likely an excellent time to engage the services of someone with experience dealing with things like that.

The important thing is to make sure you file every year. You don’t want to get behind in your taxes. Sadly, saying “I didn’t know” isn’t an excuse. Uncle Sam wants his money. Make sure you set something aside for taxes every month.